The AI OS for Trading

Deploy proven algorithms to lightning-fast VPS. Automate with AI workflows. All in one platform.

Trade Any Market

Built for traders who don't compromise

Join a community that values speed, reliability, and results

Trading doesn't have to be complicated

Stop wrestling with infrastructure. Start profiting.

Deploy proven algorithms in seconds

Pre-configured MT5 VPS ready instantly

Verified performance history included

Your bots trade while you sleep

Manual trading eating your time?

VPS setup taking hours?

Algorithm backtesting unclear?

24/7 monitoring impossible?

Everything you need to automate trading

From proven algorithms to lightning-fast VPS and intelligent automation. Deploy your complete trading stack in minutes.

Lightning-Fast VPS Hosting

MT5 pre-installed servers with 99.9% uptime. Deploy in under 2 minutes. Your bots never sleep.

Global Infrastructure

Servers deployed across multiple continents for ultra-low latency trading.

Algorithms Marketplace

Real performance data from proven strategies. No guessing, just results you can trust.

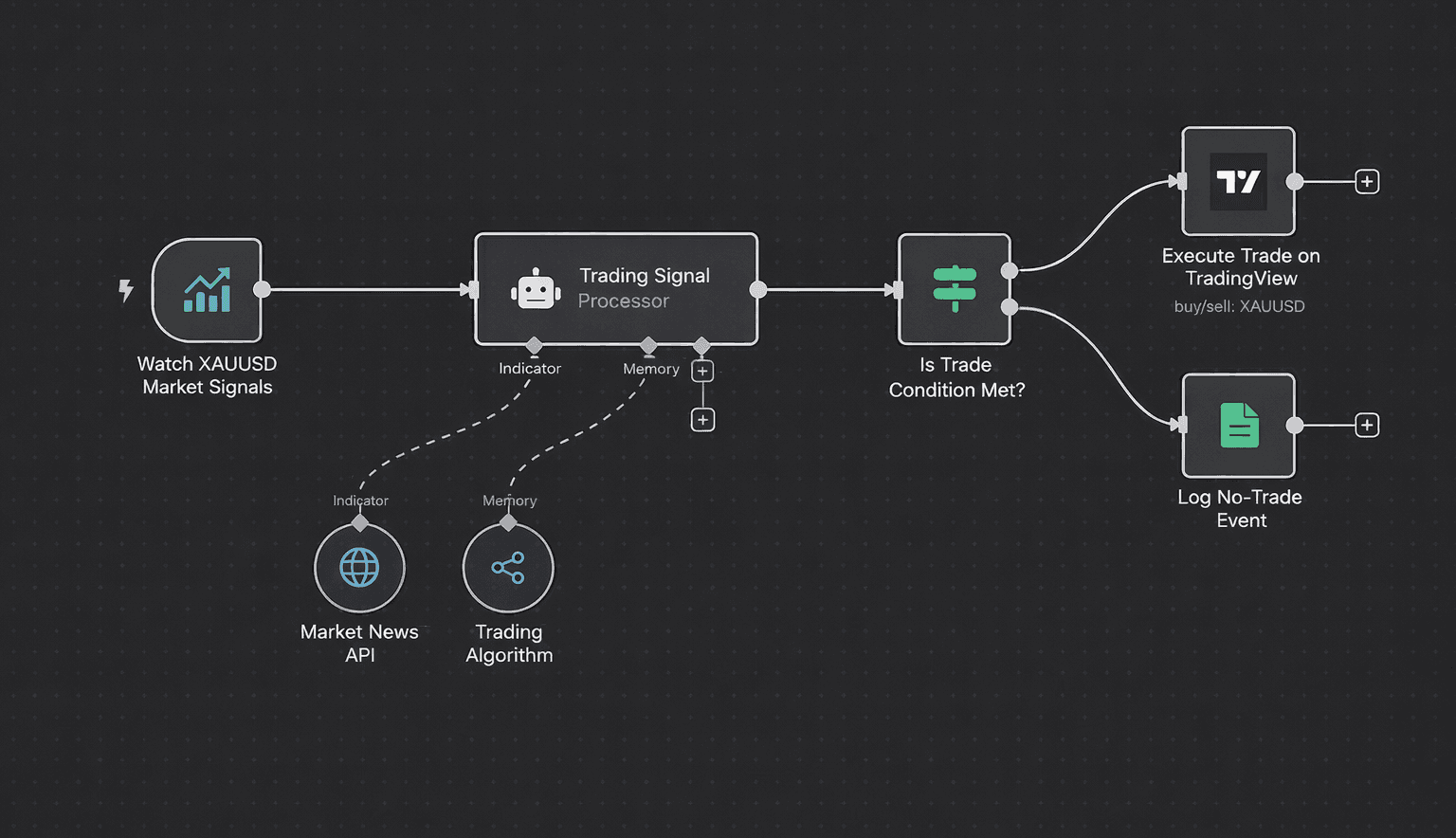

AI-Powered Workflows

Automate anything with no-code workflows. Connect MT5 to news feeds, market data, and custom triggers.

Real Traders, Real Results

Don't take our word for it

Join 20+ traders who've automated their way to better results

"Connected MT5 to news feeds in under 10 minutes. My strategies now react instantly. Game changer."

Modak

Full-Time Trader

"My bots never sleep. One-click MT5 setup saved me hours of configuration headaches."

Vaishnav

Algorithmic Trader

"Found a profitable gold scalper with 3 months of verified profits. Finally, transparency."

Swaraj

Forex Trader

4.7/5

Average user rating

99.9%

VPS uptime guarantee

20+

Active traders using XauMoney

Stop trading manually.

Start trading smarter.

Join 20+ traders who've automated their way to better results. Get started in minutes.

Deploy in under 2 minutes • Cancel anytime